In a recent shift in the financial sector, performance indicators have started to outshine equity trends. As global markets experience economic volatility due to various factors such as geopolitical tensions and inflation concerns, investors are beginning to favour financial instruments that offer more stability and better returns.

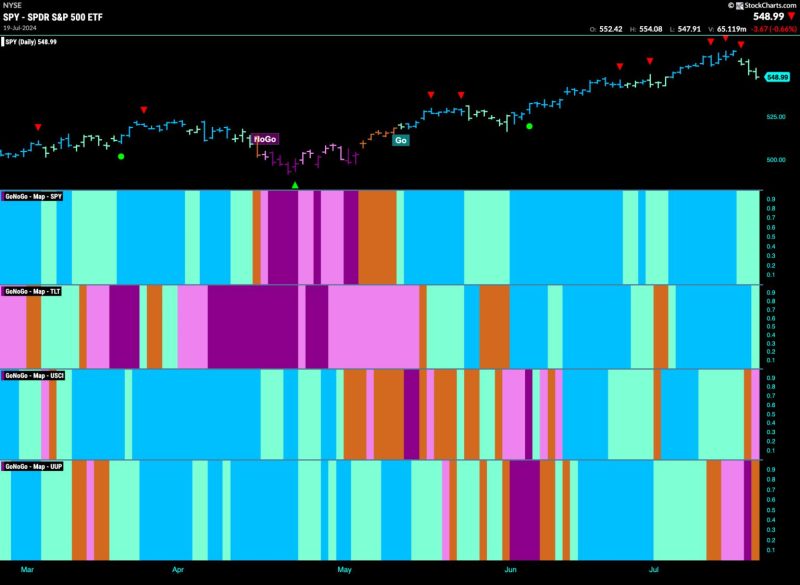

One of the key reasons driving this change in preferences is the growing uncertainty surrounding equity markets. With stock valuations experiencing fluctuations and higher levels of market risk, investors are becoming increasingly cautious about the sustainability of their returns. In contrast, financial instruments such as bonds and commodities are perceived as more resilient during times of market turbulence, offering a more secure investment option for risk-averse individuals.

Additionally, the recent performance of financial assets has been notably strong, outperforming equity markets in terms of returns and stability. Bonds, for example, have seen increased demand as investors seek safe-haven assets to protect their wealth. The stability and predictability of fixed income securities make them an attractive option in times of market uncertainty, leading to a surge in bond prices and yields.

Commodities have also witnessed a resurgence in popularity as investors turn to tangible assets to shield themselves from inflationary pressures. Gold, in particular, has seen a significant uptick in demand, with its value soaring to record highs. The precious metal is often considered a traditional safe-haven asset, providing a hedge against economic instability and currency devaluation.

Furthermore, the performance of financial institutions has been robust, with banks and other financial service providers reporting healthy profits and strong balance sheets. The improvement in financial health has instilled greater confidence in investors, who view these institutions as reliable and well-equipped to weather economic uncertainties.

Overall, the current shift towards financial assets signals a changing investment landscape, where stability and predictability are valued over volatile equity markets. As investors continue to navigate the complexities of the global economy, the performance of financial instruments is likely to play a crucial role in shaping investment decisions and portfolio strategies in the months ahead.