The week ahead for the Nifty appears to be filled with uncertainty as a defensive setup continues to develop. This cautious tone can be attributed to various factors impacting the market sentiment. As investors navigate through this challenging environment, it is essential to stay well-informed and vigilant about key levels.

One of the critical aspects to monitor is the Nifty’s behavior around crucial support and resistance levels. These levels serve as important markers that can influence market direction. By understanding and respecting these levels, traders can make informed decisions and manage their risk effectively.

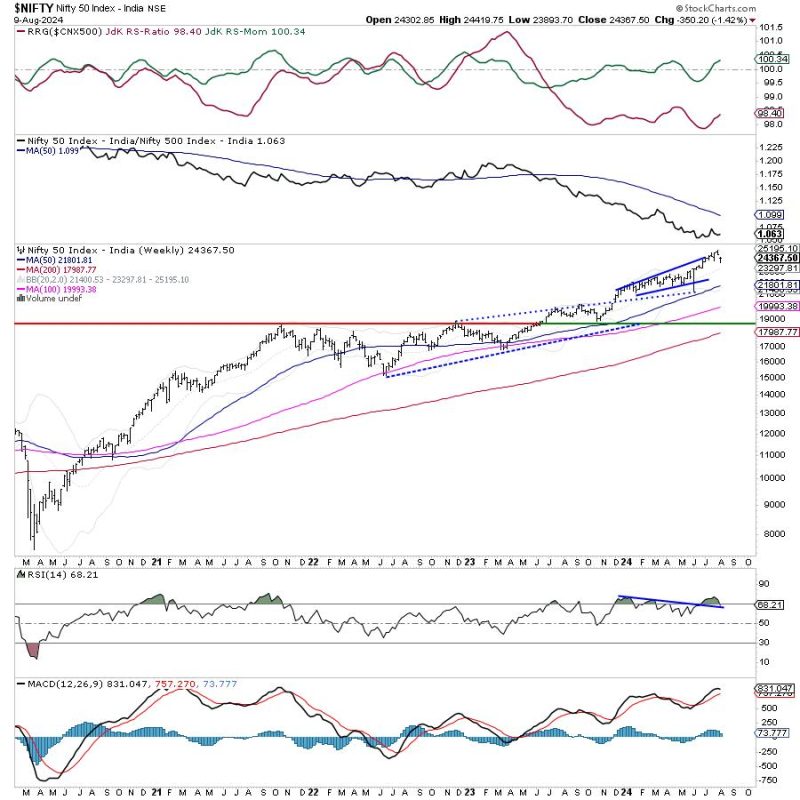

In the current market scenario, staying on top of key technical indicators is paramount. Factors such as moving averages, trendlines, and momentum oscillators can provide valuable insights into market dynamics. By analyzing these indicators in conjunction with price action, traders can gain a more comprehensive view of the market and its potential direction.

Another factor to consider is the news flow and external developments that can impact market sentiment. Geopolitical events, economic data releases, and corporate earnings reports can all act as catalysts for market movements. Staying abreast of these developments and their potential implications on the market can help traders stay ahead of the curve.

Risk management is another crucial aspect to focus on during uncertain market conditions. Setting clear stop-loss levels, maintaining proper position sizing, and adhering to a disciplined trading strategy are all essential components of effective risk management. By prioritizing risk management, traders can protect their capital and navigate volatile market conditions more effectively.

In conclusion, the Nifty appears to be in a tentative phase as a defensive setup continues to develop. By staying informed about key support and resistance levels, monitoring technical indicators, staying abreast of news flow, and prioritizing risk management, traders can navigate through the uncertainties of the market with greater confidence and resilience.