The market scenario for Nifty in the upcoming week is likely to remain within a narrow range, with significant trending movements possible only if specific threshold levels are surpassed. Keeping a close watch on these key levels can help investors anticipate potential breakout or breakdown scenarios in the market.

1. Support and Resistance Levels:

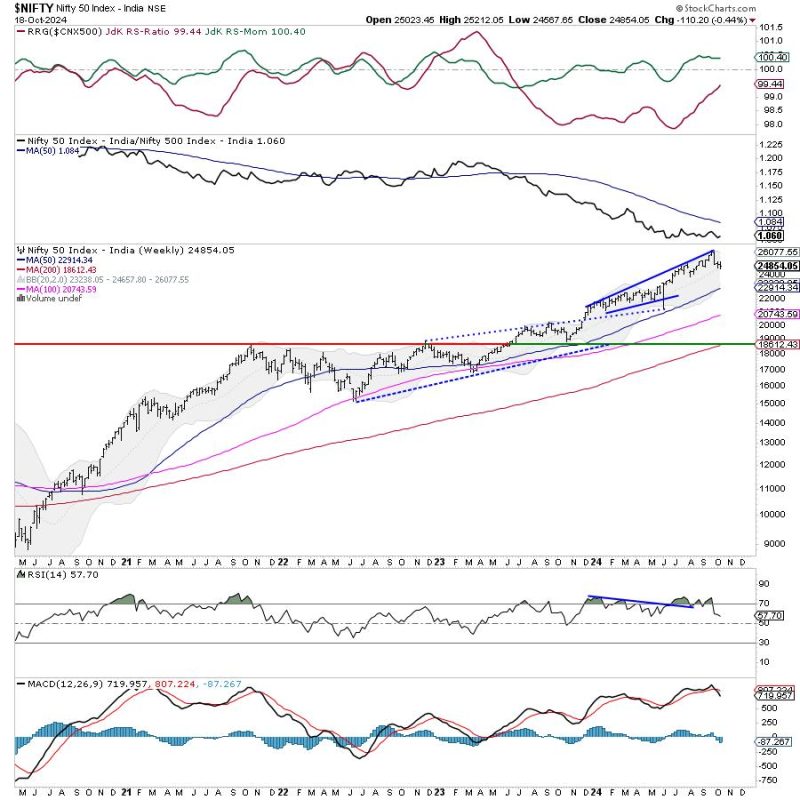

Understanding the support and resistance levels is crucial in gauging the potential movements of the Nifty index. Traders should pay close attention to the support level, below which the index might experience further declines. Similarly, the resistance level signifies the point at which the index could face selling pressure.

2. Trend Analysis:

Analyzing the prevailing trend in the market is essential for making informed trading decisions. By identifying the direction in which the Nifty index is moving, traders can align their strategies accordingly. A trend-following approach can help traders capitalize on the momentum in the market.

3. Technical Indicators:

Utilizing technical indicators can provide valuable insights into the market dynamics. Indicators such as Moving Averages, Relative Strength Index (RSI), and MACD can help traders identify potential entry and exit points. Additionally, trend lines and chart patterns can offer visual cues on the market direction.

4. Volatility and Market Sentiment:

Assessing market volatility and sentiment can aid in understanding the broader market outlook. High volatility levels may indicate increased uncertainty, while extreme sentiments could suggest potential market reversals. Keeping track of global events and economic indicators can also influence market sentiment.

5. Risk Management:

Implementing sound risk management practices is essential for safeguarding capital in trading. Setting stop-loss orders, diversifying investments, and managing position sizes can help mitigate potential losses. Staying disciplined and adhering to a well-defined trading plan is crucial for long-term success.

6. Fundamental Analysis:

Incorporating fundamental analysis alongside technical analysis can provide a holistic view of the market. Considering economic factors, corporate earnings, and geopolitical events can offer valuable insights into market trends. Investors should stay informed about key developments that could impact the Nifty index.

By staying vigilant and monitoring key levels and indicators, traders can navigate the dynamic market environment with greater confidence. Adapting to changing market conditions and being proactive in adjusting strategies can help investors capitalize on trading opportunities and manage risks effectively.