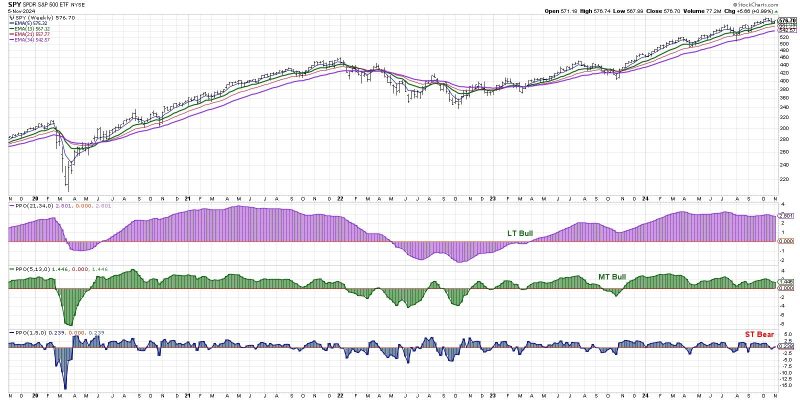

The article discusses the recent short-term bearish signal in the markets as investors brace for a news-heavy week. The post highlights important factors contributing to the current market sentiment, with a focus on the impact of upcoming news events. Market analysis indicates a potential downturn in the short term, prompting investors to exercise caution in their trading decisions.

The article points out that market volatility is likely to increase as significant news announcements are scheduled for the upcoming week. Investors are advised to closely monitor these events as they could have a pronounced effect on market movements. The anticipation of these news releases has already led to a sense of uncertainty among traders, prompting a more conservative approach to investments.

Furthermore, the article emphasizes the importance of risk management strategies during periods of heightened market uncertainty. Investors are encouraged to diversify their portfolios, set stop-loss orders, and stay informed about market developments to mitigate potential losses. By staying proactive and adaptable, investors can navigate the current market conditions more effectively and protect their investments.

In conclusion, the article provides valuable insights into the short-term bearish signal in the markets and the impact of upcoming news events on investor sentiment. By remaining vigilant and implementing sound risk management strategies, investors can better position themselves to weather market fluctuations and make informed decisions in the face of uncertainty.