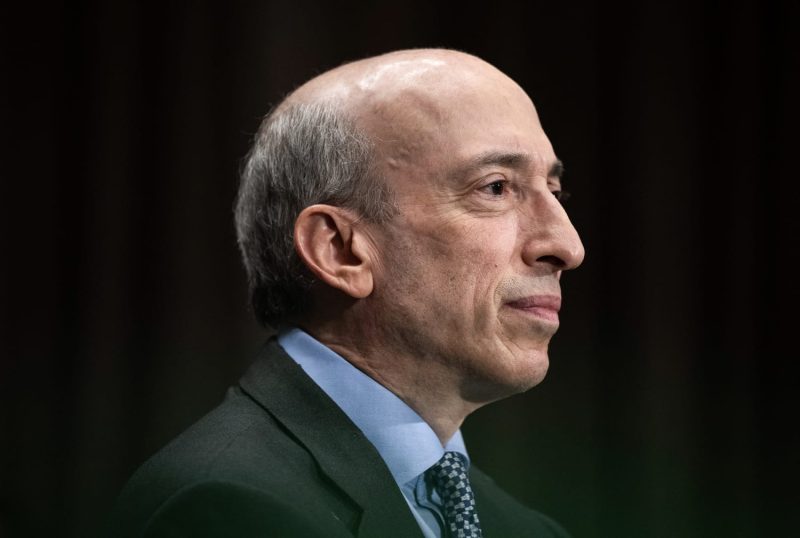

In a surprising turn of events, Securities and Exchange Commission Chair Gary Gensler has announced his decision to step down from his position on January 20th, paving the way for a replacement to be appointed by former President Donald Trump. Gensler’s departure raises questions about the future direction of the SEC and the potential implications for financial markets and regulation.

During his tenure as Chair of the SEC, Gensler made significant strides in enhancing regulatory oversight and enforcement in the financial sector. He prioritized transparency, accountability, and investor protection in his approach to regulation, often clashing with industry stakeholders over his rigorous enforcement actions.

One of Gensler’s key achievements was his focus on cryptocurrency and digital asset regulation. Under his leadership, the SEC took steps to clarify the regulatory framework for cryptocurrencies, such as Bitcoin and Ethereum, and initiated enforcement actions against fraudulent Initial Coin Offerings (ICOs) and crypto projects. Gensler’s departure leaves a void in the SEC’s initiatives in this rapidly evolving sector.

The timing of Gensler’s decision to step down, just days before President Trump’s replacement, underscores the potential for a shift in regulatory priorities and enforcement strategies at the SEC. Critics argue that a new appointee by Trump may roll back some of the regulations implemented under Gensler, potentially weakening investor protections and market integrity.

The uncertainty surrounding the upcoming leadership change at the SEC has already had a noticeable impact on financial markets. Stock prices of companies heavily regulated by the SEC, such as financial institutions and tech firms, have experienced fluctuations as investors brace for potential changes in regulatory policies.

In conclusion, Gary Gensler’s impending departure as SEC Chair marks the end of an era characterized by heightened regulatory scrutiny and enforcement in the financial markets. As the SEC prepares for a new leadership transition, stakeholders are closely monitoring developments to assess the potential implications for investor protection, market stability, and regulatory certainty. Only time will tell how the SEC’s priorities and enforcement actions will evolve under new leadership in the months to come.