The Hindenburg Omen: Understanding its Impact on Stock Market Trends

The stock market is a complex and dynamic system driven by a multitude of factors, including economic indicators, investor sentiment, and technical analysis. One such technical indicator that has garnered attention among market watchers is the Hindenburg Omen. This indicator, named after the famous Hindenburg airship disaster, is believed to provide insight into potential market downturns by identifying periods of increased market volatility and uncertainty.

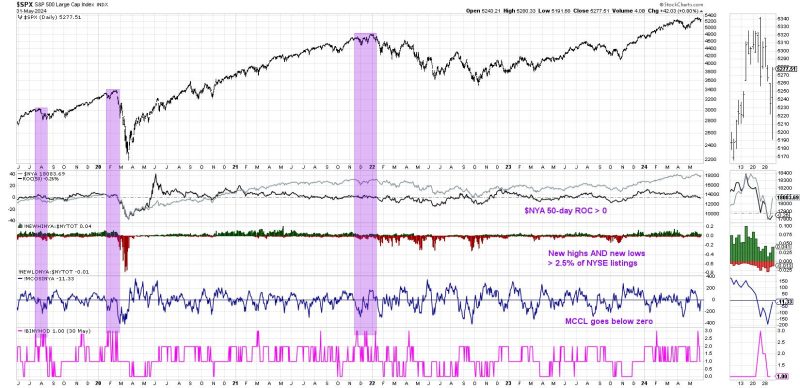

The Hindenburg Omen is a signal that occurs when a set of specific criteria are met within the stock market. These criteria typically include a high number of stocks reaching new highs and new lows simultaneously, combined with a number of advancing and declining issues within the market. When these conditions are met, it is believed to signal a potential market correction or crash. While the Hindenburg Omen is not a foolproof indicator and has produced both false positives and false negatives in the past, many analysts still consider it to be a valuable tool in assessing market risk.

One of the key reasons why the Hindenburg Omen is closely followed by market participants is its historical correlation with significant market downturns. Past occurrences of the Hindenburg Omen have often been followed by periods of heightened market volatility and bearish sentiment, leading to significant declines in stock prices. As a result, investors and traders pay close attention to the appearance of the Hindenburg Omen as a potential warning sign of looming market turbulence.

It is important to note, however, that the Hindenburg Omen is just one of many indicators used to assess market conditions, and its predictive power should not be relied upon in isolation. Market dynamics are influenced by a wide range of factors, and no single indicator can accurately forecast future market movements with absolute certainty. As such, investors are advised to use the Hindenburg Omen in conjunction with other technical and fundamental analysis tools to make well-informed investment decisions.

In conclusion, the Hindenburg Omen serves as a valuable gauge of market sentiment and risk, offering insights into potential market downturns. While its accuracy may vary and false signals can occur, the Hindenburg Omen remains a popular tool among traders and analysts seeking to navigate the complexities of the stock market. By understanding the criteria and implications of the Hindenburg Omen, investors can better prepare themselves for the uncertainties of the market and make informed decisions to safeguard their investments.