When assessing the state of the current market landscape, investors are often met with a mix of optimism and caution. Recent trends have led some to believe that the market may be reaching a toppy state, a term used to describe a market that is potentially nearing its peak before a downturn. Analyzing various indicators and signals can provide insights into whether the market truly appears to be topping out.

One key metric that investors often look at is the price-to-earnings (P/E) ratio. A high P/E ratio may indicate that stocks are overvalued, potentially signaling that the market is becoming overheated. Additionally, other valuation metrics such as price-to-sales and price-to-book ratios can offer further clues into whether stocks are trading at unsustainable levels.

Another factor to consider is market sentiment. Extreme optimism among investors can sometimes be a contrarian indicator, suggesting that the market may be due for a correction. Conversely, heightened fear and uncertainty can also signal a potential turning point in the market.

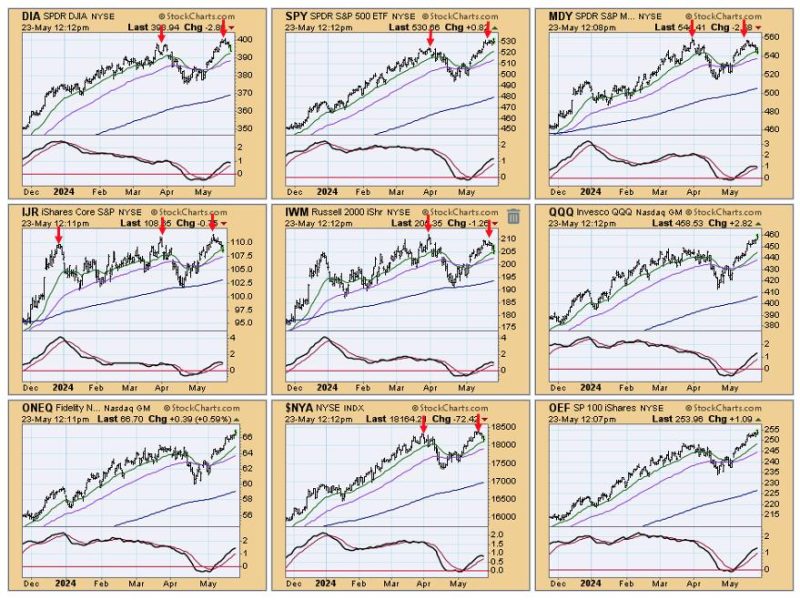

Technical analysis can also provide valuable insights into the market’s health. Chart patterns such as double tops and head and shoulders formations can indicate a potential trend reversal. Monitoring key moving averages and support levels can help investors gauge the overall strength of the market.

Geopolitical events and macroeconomic factors can also influence market dynamics. Uncertainty surrounding trade tensions, interest rates, and global economic growth can introduce volatility and risks to the market. Keeping a close eye on these developments can help investors navigate potential headwinds.

While signs of a toppish market may be present, it is important for investors to exercise caution and remain vigilant. Diversification, risk management strategies, and a long-term perspective can help mitigate potential losses during market downturns. By staying informed and adaptable, investors can navigate volatile market conditions and position themselves for long-term success.