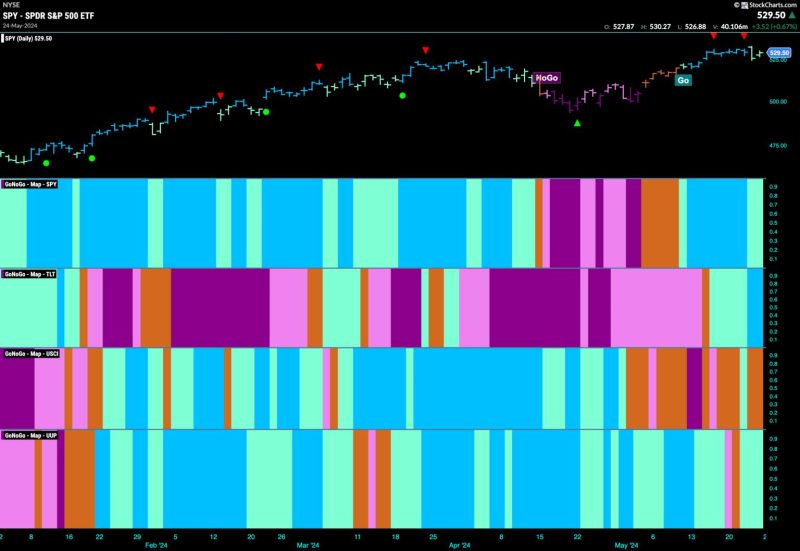

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The current landscape of the stock market is depicting an interesting scenario, as equities continue to tread in a go trend. This trend, characterized by a steady upward movement in the overall stock market performance, is being navigated with only intermittent leadership from the tech and utilities sectors.

Tech, a traditionally strong sector in driving market performance, has shown moments of brilliance but also periods of consolidation. The current scenario is witnessing tech stocks grappling with uncertainties surrounding regulatory concerns, global supply chain disruptions, and high valuations. These factors have contributed to a somewhat subdued leadership role from the tech sector in propelling equities higher.

On the other hand, the utilities sector, known for its stability and defensive nature, has experienced a mixed bag of performance. While some utility companies have managed to stay resilient and provide steady returns to investors, others have been facing challenges in adapting to evolving regulatory environments and shifting consumer preferences towards renewable energy sources. This mixed performance has failed to position utilities as a strong driver of the go trend in equities.

Amidst the sparse leadership from tech and utilities, other sectors have stepped up to fill the void and contribute to the overall positive momentum in the stock market. Industries such as healthcare, consumer discretionary, and financials have shown promising signs of growth and resilience, bolstering investor confidence and keeping the go trend intact.

Furthermore, macroeconomic factors such as monetary policy decisions, inflationary pressures, and geopolitical developments continue to play a crucial role in shaping market dynamics and influencing investor sentiment. The Federal Reserve’s stance on interest rates, central bank policies in major economies, and trade relations between nations are all factors that investors closely monitor to gauge the direction of equities in the current environment.

In conclusion, while tech and utilities have exhibited sporadic leadership in driving the go trend in equities, the overall market remains buoyant with support from other sectors and macroeconomic conditions. Investors need to remain vigilant, diversify their portfolios, and stay informed about market developments to navigate the evolving landscape of equities successfully.