In the dynamic world of investment and trading, precise and timely signals play a crucial role in decision-making. Recently, several prominent exchange-traded funds (ETFs) have received silver cross buy signals, indicating a potentially positive momentum shift. Notable among these are the iShares Russell 2000 ETF (IWM) and the iShares US Retail ETF (IYT), both of which have generated significant interest among investors and traders alike.

The iShares Russell 2000 ETF (IWM) holds a diverse portfolio of small-cap stocks, offering exposure to companies with strong growth potential. Small-cap stocks have historically outperformed large-cap stocks over the long term, albeit with higher volatility. The recent silver cross buy signal for IWM indicates a potential uptrend in the small-cap segment, highlighting the attractiveness of this ETF for investors seeking capital appreciation.

On the other hand, the iShares US Retail ETF (IYT) provides exposure to the retail sector, encompassing a wide range of companies engaged in retail sales. The retail sector can be influenced by various factors such as consumer sentiment, economic conditions, and industry trends. The silver cross buy signal for IYT suggests a positive outlook for retail stocks, signaling a possible reversal in the downtrend and presenting a buying opportunity for investors optimistic about the sector’s future performance.

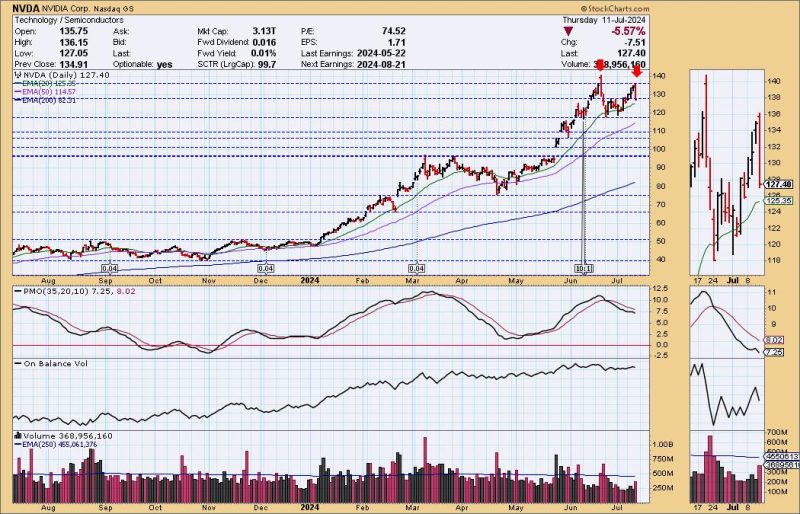

In addition to IWM and IYT, the NVDA stock has also received a silver cross buy signal, further reflecting the overall positive sentiment in the market. NVIDIA Corporation is a leading semiconductor company known for its cutting-edge technology and innovative products. The silver cross buy signal for NVDA underscores the company’s growth potential and market strength, attracting the attention of both institutional and retail investors seeking exposure to the technology sector’s growth prospects.

Overall, silver cross buy signals serve as valuable indicators for investors looking to capitalize on shifting market trends and potential opportunities for capital appreciation. While these signals do not guarantee future performance, they can provide useful insights and guidance for making informed investment decisions. As always, it is essential for investors to conduct thorough research, assess their risk tolerance, and diversify their portfolios to achieve their financial goals successfully.