The 1-2-3 Reversal Pattern: A Trader’s Guide

Understanding chart patterns is an essential skill for successful traders in the financial markets. One such pattern that is highly valued by traders is the 1-2-3 Reversal Pattern. This pattern is based on the principle of trend reversals and can provide traders with valuable insights into potential changes in market direction.

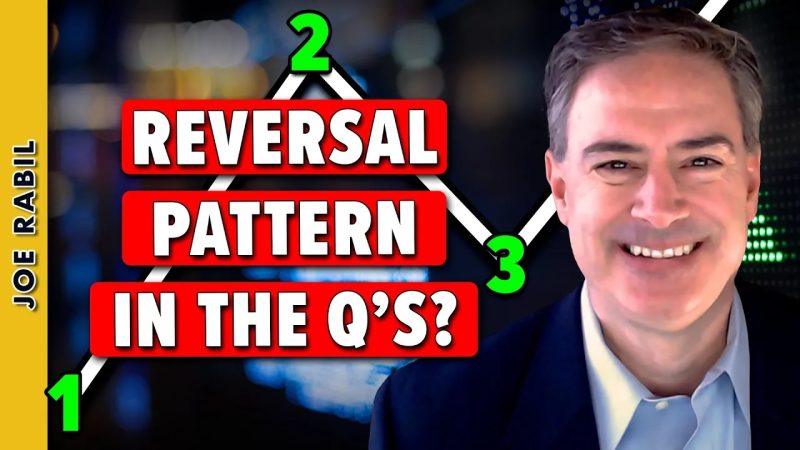

What is the 1-2-3 Reversal Pattern?

The 1-2-3 Reversal Pattern is a technical analysis pattern that signals a potential trend reversal. The pattern consists of three key components: the initial trend, the reversal, and the confirmation. In an uptrend, the pattern starts with a high point (1), followed by a lower high (2), and finally a break below the low point between points 1 and 2, forming the reversal point (3). Conversely, in a downtrend, the pattern begins with a low point (1), a higher low (2), and a break above the high point between points 1 and 2 to form the reversal point (3).

How to Use the 1-2-3 Reversal Pattern

Identifying the 1-2-3 Reversal Pattern on a price chart is the first step in using this pattern effectively. Once the pattern is recognized, traders can take advantage of it in various ways:

Confirmation: Wait for the confirmation of the pattern before making any trading decisions. This confirmation could come in the form of a strong price move in the direction of the reversal.

Entry and Stop-Loss Placement: Traders can enter a trade on the break of the confirmation level, in the direction of the reversal. Stop-loss orders can be placed above or below the pattern, depending on the direction of the trade.

Profit Target: To determine a profit target, traders can use traditional technical analysis tools such as support and resistance levels, Fibonacci retracements, or trend lines.

Risk Management: Implement proper risk management strategies to protect trading capital. This may include setting risk-to-reward ratios, trailing stop-loss orders, or position sizing based on risk tolerance.

Practice and Patience: Like any trading strategy, mastering the 1-2-3 Reversal Pattern takes practice and patience. Traders should backtest the pattern on historical data and paper trade before implementing it with real money.

In conclusion, the 1-2-3 Reversal Pattern is a powerful tool for traders looking to identify potential trend reversals in the financial markets. By understanding the pattern and following a systematic approach to trading it, traders can improve their trading performance and increase their chances of success in the market.