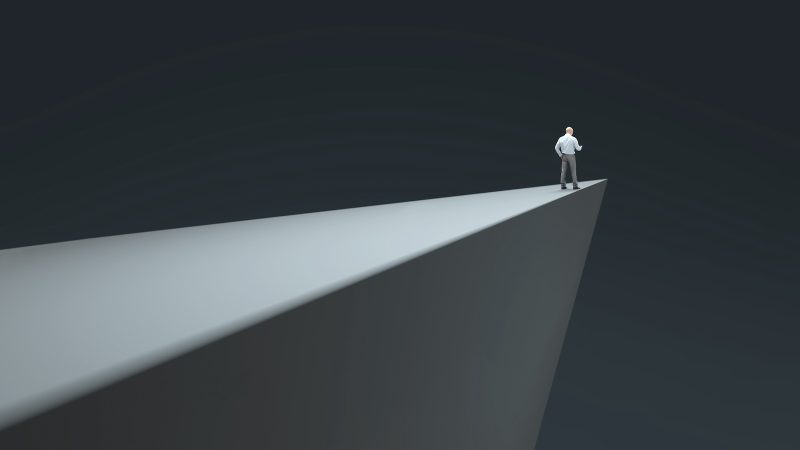

In recent weeks, the Nasdaq has been teetering on the edge, with market analysts closely monitoring critical levels that could indicate the direction of future movements. The sharp sell-off in technology stocks has led to increased volatility in the market, causing uncertainty among investors and traders alike.

One of the key levels to watch is the 50-day moving average, which acts as a crucial support level for the Nasdaq. If the index continues to trade below this level, it could signal further downside potential. On the other hand, a successful bounce off the 50-day moving average could bring some relief to market participants and pave the way for a potential rebound.

Another important level to keep an eye on is the 200-day moving average, which provides a longer-term perspective on the market trend. A sustained breach below this level could indicate a more pronounced bearish sentiment, leading to further downside momentum. However, a strong bounce off the 200-day moving average could suggest that the market is finding support at this key level.

In addition to moving averages, technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can provide valuable insights into the momentum and strength of the market. An RSI reading below 30 could indicate an oversold condition, potentially signaling a buying opportunity for traders looking to capitalize on a potential reversal. Conversely, an RSI reading above 70 could suggest an overbought condition, raising concerns about a possible pullback in the market.

The MACD, which measures the relationship between two moving averages, can also help traders identify potential trend reversals. A bullish crossover, where the shorter-term moving average crosses above the longer-term moving average, could indicate a shift towards a more positive market sentiment. Conversely, a bearish crossover could suggest a potential downside movement in the market.

Overall, keeping a close watch on these critical levels and technical indicators can help investors navigate the current market environment and make informed decisions about their trading strategies. While the Nasdaq remains on shaky ground, staying vigilant and adapting to changing market conditions can help traders weather the storm and capitalize on potential opportunities that may arise in the future.