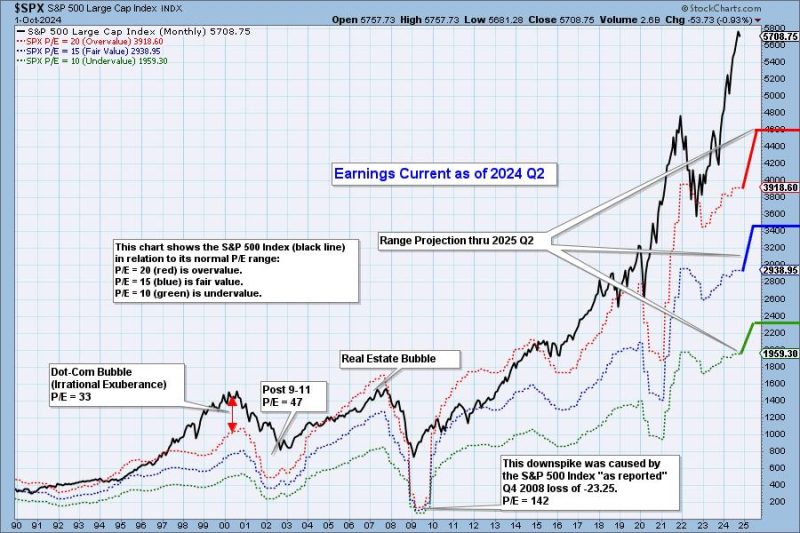

In the world of finance and investment, the evaluation of market valuations is an essential practice for both individual and institutional investors. The latest market reports analyzing the second-quarter earnings of 2024 have brought to light the concerning trend of the market being deemed as very overvalued. This assessment of the market’s valuation presents investors with valuable insights that can guide their decision-making processes and investment strategies. In this article, we delve deeper into the implications and potential repercussions of an overvalued market.

One of the primary concerns associated with an overvalued market is the heightened risk of a market correction or crash. When market valuations exceed the intrinsic value of assets, it creates an unsustainable environment that is vulnerable to sudden and significant price declines. Investors who have heavily invested in overvalued assets may face substantial losses if the market undergoes a correction, leading to a negative impact on their portfolios and financial well-being.

Moreover, an overvalued market can also dampen future returns on investments. As asset prices become disconnected from their underlying fundamentals, the potential for substantial growth and appreciation diminishes. This can limit the profit potential for investors and hinder their ability to generate significant returns on their investments over the long term. As a result, investors may need to reassess their investment strategies and consider reallocating their portfolios to mitigate the risks associated with an overvalued market.

Furthermore, an overvalued market may also contribute to increased market volatility and uncertainty. Price fluctuations and erratic market behavior are more likely in an environment where valuations are stretched beyond reasonable levels. This heightened volatility can create challenges for investors in terms of managing risk, making informed decisions, and navigating the market effectively. It is imperative for investors to adopt a cautious and vigilant approach in such market conditions to safeguard their investments and financial interests.

In conclusion, the latest market assessments indicating that the market remains very overvalued underscore the importance of prudent and strategic investment management. Investors should pay close attention to market valuations, conduct thorough research and analysis, and seek professional guidance to make informed decisions about their investments. By understanding the implications of an overvalued market and taking proactive measures to mitigate risks, investors can position themselves for long-term financial success and stability amidst dynamic market conditions.