Alphafold, a UK-based artificial intelligence company, has been making waves in the world of biotechnology with its groundbreaking protein folding technology. Investors are keen to get a piece of the action and invest in Alphafold stock. Here are some key points to consider before making an investment in this innovative company.

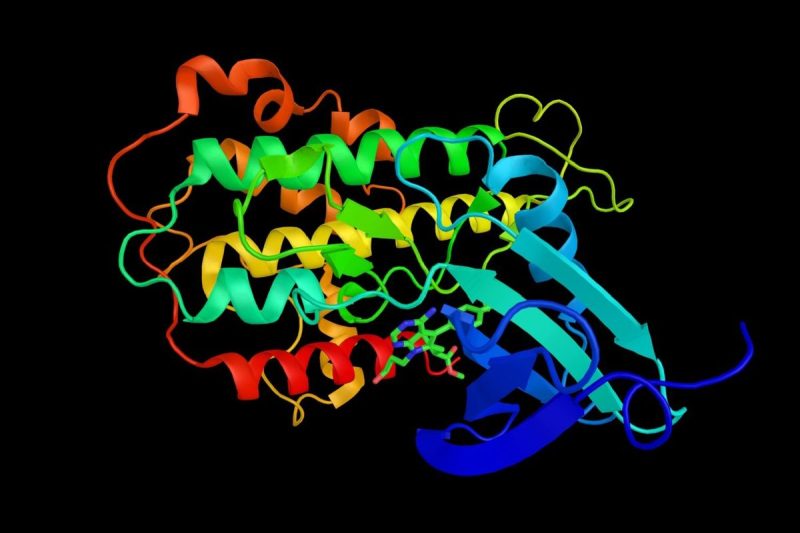

1. **Understand the Technology**: Alphafold uses deep learning algorithms to predict the 3D structure of proteins, which is essential for drug discovery, disease understanding, and biotechnology advancements. Understanding the technology behind Alphafold’s success is crucial for investors to assess the potential growth and sustainability of the company.

2. **Market Demand and Competition**: Investors should assess the market demand for protein folding technology and the level of competition in the industry. Alphafold’s unique approach has the potential to disrupt the biotechnology sector, but it’s essential to evaluate how the company stands against competitors and how it plans to maintain its competitive edge.

3. **Financial Health**: Before investing in Alphafold stock, it is vital to analyze the company’s financial health. Evaluating key financial indicators such as revenue growth, profit margins, and cash flow can provide insights into the company’s performance and future prospects. Investors should also consider Alphafold’s funding sources and investment plans.

4. **Regulatory Environment**: The biotechnology industry is a highly regulated sector, with stringent guidelines and approval processes for new technologies and products. Investors should be aware of the regulatory environment in which Alphafold operates and the potential impact of regulatory changes on the company’s operations and growth prospects.

5. **Long-Term Outlook**: Investment in Alphafold stock should align with your long-term investment goals and risk tolerance. While the company’s innovative technology presents exciting opportunities for growth, investors should also be prepared for potential risks and uncertainties that come with investing in a high-growth sector.

In conclusion, investing in Alphafold stock can be a rewarding opportunity for investors looking to capitalize on the potential of artificial intelligence in the biotechnology industry. However, thorough research, understanding the technology, evaluating market demand, assessing financial health, considering the regulatory environment, and aligning investment goals are crucial steps to make an informed investment decision in Alphafold.