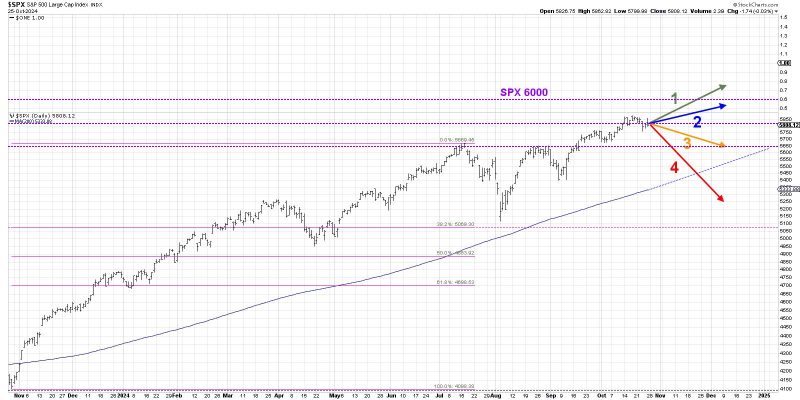

The article mentioned in the reference link discusses the possibility of the S&P 500 index reaching 6000 points. While the article provides some valuable insights and analysis, there are several key points to consider regarding the potential of the S&P 500 breaking the 6000 point barrier.

Firstly, it is important to analyze the current market conditions and trends. The S&P 500 index has shown significant growth over the past few years, reaching record highs. However, it is crucial to understand that the stock market is inherently volatile and subject to various external factors such as economic data, geopolitical events, and investor sentiment.

One of the primary factors influencing the movement of the S&P 500 index is corporate earnings. Earnings reports play a critical role in driving stock prices, and if companies continue to deliver strong earnings growth, it could propel the index higher. On the other hand, any unexpected downturn in earnings could lead to a pullback in the market.

Additionally, the Federal Reserve’s monetary policy decisions also impact the stock market. The central bank’s actions regarding interest rates and economic stimulus measures can influence investor confidence and market performance. Any changes in the Fed’s policy stance could have significant implications for the direction of the S&P 500 index.

Moreover, geopolitical events and macroeconomic data can also sway investor sentiment and market dynamics. Factors such as trade tensions, political instability, and global economic indicators can create uncertainty in the market, leading to fluctuations in stock prices.

While the S&P 500 index has shown resilience and growth in recent years, investors should exercise caution and remain vigilant of potential risks and uncertainties. Achieving the milestone of 6000 points will require sustained economic growth, robust corporate performance, and favorable market conditions.

In conclusion, while the prospect of the S&P 500 reaching 6000 points is tantalizing, it is essential to consider the various factors that could impact its trajectory. Investors should conduct thorough research, diversify their portfolios, and stay informed about market developments to make well-informed investment decisions. The stock market is dynamic and ever-evolving, and it is crucial to approach investing with a long-term perspective and risk management strategy.