Secular Bull Market Continues but With Major Rotation

The current investment landscape continues to unfold against the backdrop of a secular bull market that shows no signs of wavering. Investors around the world are witnessing an era of continued growth and opportunity, fueled by various economic factors and market dynamics. However, a significant theme emerging within this prevailing trend is the major rotation that is reshaping the investment landscape and testing the strategies of even the most seasoned investors.

Historically, secular bull markets have been characterized by extended periods of rising asset prices, driven by strong economic growth, low inflation, and favorable market conditions. The current secular bull market, which has been underway since the Great Recession, has been no exception. Stock markets have surged to new heights, fueled by a potent combination of corporate earnings growth, accommodative monetary policies, and robust investor sentiment.

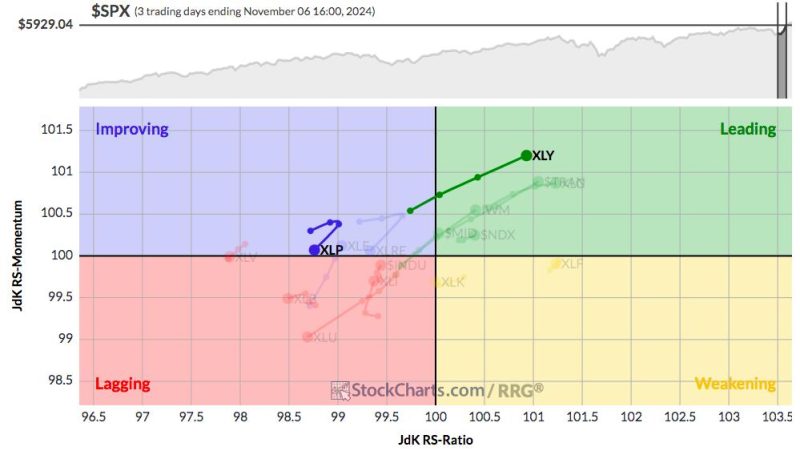

Despite the overall bullish sentiment, a notable shift is taking place beneath the surface of the market. This shift comes in the form of a major rotation in investment themes and sectors, as investors recalibrate their portfolios to adapt to changing market conditions. The once-dominant sectors that led the market higher are now facing headwinds, while previously overlooked sectors are emerging as new leaders.

One of the key drivers of this rotation is the changing outlook for interest rates and inflation. As central banks around the world begin to signal a tightening of monetary policy in response to rising inflationary pressures, investors are reassessing their exposure to interest rate-sensitive sectors such as technology and growth stocks. At the same time, sectors that have traditionally performed well in a rising rate environment, such as financials and commodities, are gaining favor among investors.

Another factor contributing to the rotation is the shifting dynamics of the global economy. The ongoing trade tensions between the US and China, geopolitical uncertainties, and the evolving technological landscape are all playing a role in reshaping the investment landscape. As investors navigate these complex and interconnected risks, sectors that offer stability, resilience, and growth potential are attracting increased attention.

The COVID-19 pandemic has also played a significant role in accelerating the rotation within the market. The crisis has exposed vulnerabilities in certain sectors while highlighting the resiliency of others. As the world emerges from the pandemic and economies begin to recover, investors are positioning themselves to benefit from the changing consumer behaviors and preferences that have emerged in the wake of the crisis.

In conclusion, while the secular bull market continues to propel asset prices higher, investors must remain vigilant and adaptive in navigating the major rotation that is reshaping the investment landscape. By recognizing the shifting trends, identifying emerging opportunities, and diversifying their portfolios, investors can position themselves to thrive in the ever-evolving market environment. As the saying goes, the only constant in the financial markets is change – and those who can embrace change will be best positioned for success in the long run.