As we look towards the future of investing, certain industries seem poised for growth and potential profits. One such industry that has caught the attention of many investors is the chromium market. With its wide range of industrial applications and increasing demand globally, investing in chromium stocks has become an attractive opportunity for those looking to diversify their investment portfolios. In this article, we will delve into the intricacies of investing in chromium stocks, exploring the market trends, key players, and strategies to consider in 2024.

Market Overview:

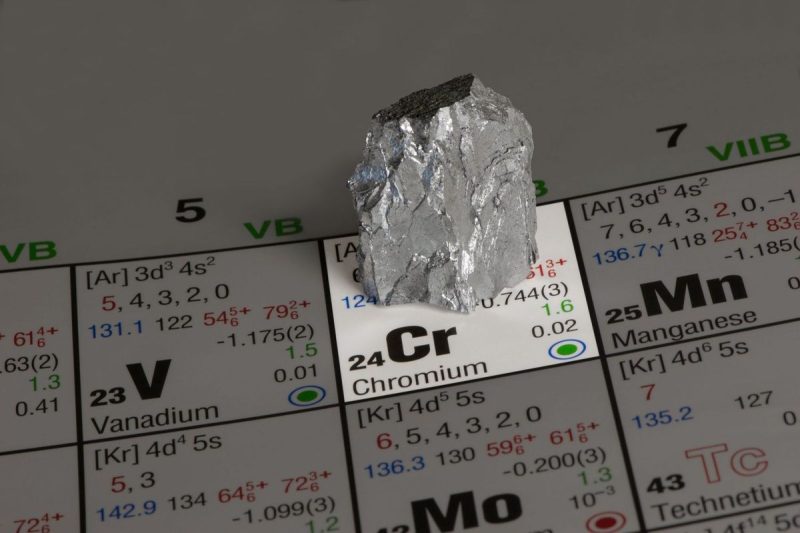

The chromium market plays a vital role in various industries, including stainless steel production, aerospace, and automotive sectors. As a corrosion-resistant element, chromium is indispensable in the manufacturing of high-quality stainless steel, making it a sought-after commodity in the market. With the growing urbanization and infrastructure development worldwide, the demand for stainless steel products is expected to rise, thereby driving the demand for chromium.

Key Players:

When considering investing in chromium stocks, it is essential to examine the key players in the market. Companies such as Glencore, Eurasian Resources Group, and South32 are major players in the chromium industry, with significant operations in mining and processing of chromium ores. These companies have a strong market presence and diversified portfolios, making them attractive investment options for those interested in the chromium sector.

Investment Strategies:

Investing in chromium stocks requires careful consideration of various factors, including market trends, company performance, and overall economic conditions. One strategy to consider is diversification, spreading your investment across multiple chromium-related companies to reduce risk exposure. Additionally, staying informed about the latest developments in the chromium market, such as changes in supply and demand dynamics, can help you make informed investment decisions.

Moreover, investors should pay attention to geopolitical factors that may impact chromium prices, such as trade policies and regulations affecting the mining industry. Conducting thorough research and seeking advice from financial experts can help you navigate the complexities of investing in the chromium sector and maximize your returns.

Conclusion:

In conclusion, investing in chromium stocks presents an exciting opportunity for investors looking to capitalize on the growing demand for this essential industrial metal. By understanding the market trends, key players, and investment strategies outlined in this article, you can make informed decisions and potentially benefit from the promising outlook of the chromium market in 2024 and beyond. Remember to conduct thorough research, stay informed, and consult with financial experts before making any investment decisions in the chromium sector.