The semiconductor industry continues to play a critical role in the advancement of technology, impacting various aspects of our daily lives. As investors look for opportunities within this sector, two prominent exchange-traded funds (ETFs), SMH and SOXX, have been under the spotlight for their performance during recent market volatility. Both funds are focused on semiconductor companies, reflecting the overall health of the industry and investor sentiment towards it.

One key aspect that sets SMH apart from SOXX is its emphasis on well-established semiconductor companies. The VanEck Vectors Semiconductor ETF (SMH) comprises a mix of large-cap companies that have a solid track record of performance and stability within the industry. These companies often have diversified revenue streams and a global presence, making them less susceptible to short-term fluctuations in demand or supply chain disruptions. As a result, SMH has demonstrated more resilience during turbulent market conditions compared to the iShares PHLX Semiconductor ETF (SOXX), which includes a broader range of semiconductor companies, including mid-cap and smaller companies that may be more volatile.

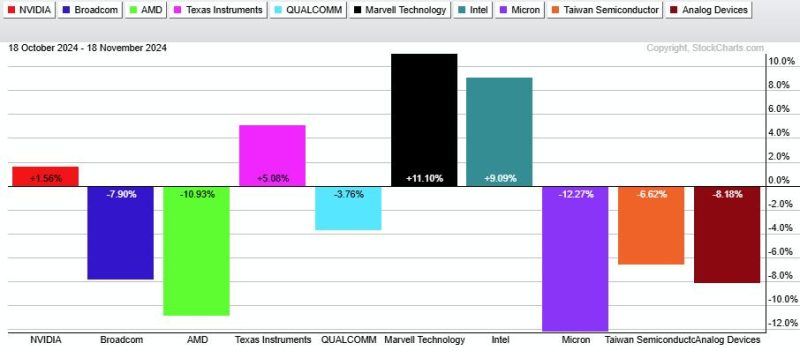

Moreover, SMH’s strategic allocation towards market leaders in the semiconductor space has contributed to its stronger performance. Top holdings in SMH, such as NVIDIA, Intel, and Taiwan Semiconductor Manufacturing Company (TSMC), have been at the forefront of innovation and have benefited from key industry trends such as artificial intelligence, data centers, and 5G technology. These companies have demonstrated solid financial performance and are well-positioned for future growth, attracting investor confidence and providing stability to the fund’s overall performance.

On the other hand, SOXX’s broader exposure to the semiconductor industry may present both opportunities and risks. While a diversified portfolio can offer potential upside from emerging companies and niche markets, it also exposes the fund to higher volatility and a greater impact from individual company performance. During periods of market uncertainty, such as supply chain disruptions or geopolitical tensions, SOXX may experience more pronounced fluctuations compared to SMH, where the strength of market leaders helps cushion the impact.

In conclusion, the choice between SMH and SOXX ultimately depends on the investor’s risk tolerance, investment horizon, and outlook on the semiconductor industry. SMH’s focus on established market leaders provides stability and resilience during turbulent market conditions, making it a suitable choice for investors seeking exposure to the sector with lower risk. On the other hand, SOXX’s diversified portfolio offers potential for higher returns but comes with higher volatility and risk. By understanding the strengths and weaknesses of each ETF, investors can make informed decisions that align with their investment objectives and risk preferences in the dynamic semiconductor sector.