In the fast-paced world of global finance and currency markets, the movements of major currencies can have a profound impact on economies and individual investors alike. One currency that always garners significant attention is the US Dollar (USD), considered a safe-haven and a benchmark against which many other currencies are valued. Recent analysis and market sentiment suggest that the USD may be poised for a significant rally. Let’s delve into the factors contributing to this potential rally and what it could mean for traders and the broader financial landscape.

1. **Federal Reserve Policy**

One of the primary drivers of USD strength is the monetary policy of the Federal Reserve (Fed), the central banking system of the United States. The Fed plays a crucial role in setting interest rates and implementing monetary policy to achieve stable prices and maximum sustainable employment. Speculation that the Fed may adopt a more hawkish stance by raising interest rates could bolster the USD by making it a more attractive investment option relative to other currencies.

2. **Economic Data and Performance**

Fundamental economic indicators also play a vital role in shaping currency movements. Strong economic data, such as robust GDP growth, low unemployment rates, and healthy consumer spending, can contribute to a positive outlook for the USD. If the US economy continues to perform well compared to its global counterparts, it may lead to increased demand for the USD in international markets.

3. **Geopolitical Events**

Geopolitical factors can significantly impact currency valuations. Uncertainty surrounding global events, such as trade disputes, political tensions, or military conflicts, can cause investors to seek the stability of the USD as a safe-haven asset. Any escalation of geopolitical risks could drive up demand for the USD and support a rally.

4. **Market Sentiment and Technical Analysis**

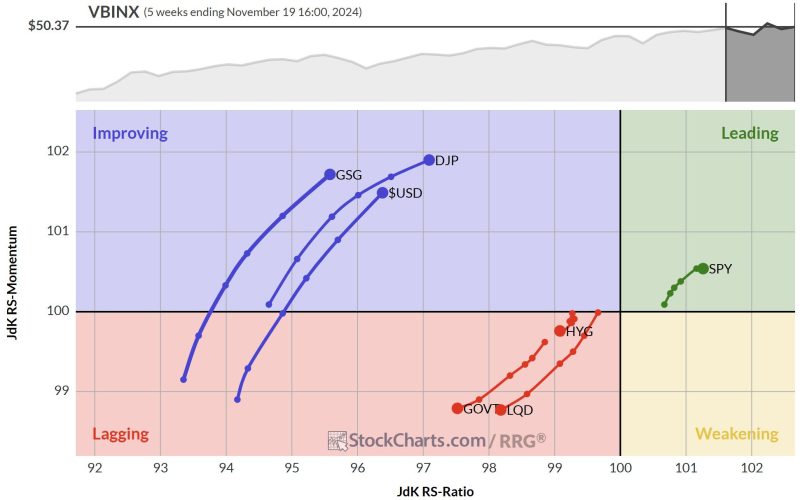

Market sentiment and technical analysis can provide valuable insights into the potential future direction of a currency. If traders perceive the USD as undervalued or potential positive news is on the horizon, sentiment may shift in favor of the currency. Additionally, technical indicators and chart patterns can signal potential breakouts or trend reversals that could drive a USD rally.

5. **Inflation and Purchasing Power**

Inflation is a critical factor influencing the value of a currency. A low inflation environment coupled with rising purchasing power can enhance the attractiveness of the USD. If inflation remains under control and consumer confidence stays high, it could support a rally in the USD by maintaining its value relative to other currencies.

6. **Market Dynamics and Risk Appetite**

The dynamics of the currency markets are influenced by a myriad of factors, including investor risk appetite, market volatility, and capital flows. A shift in sentiment towards risk aversion could lead to a flight to safety, benefiting the USD. Conversely, improvements in global economic conditions or increased risk-taking behavior could dampen USD demand.

In conclusion, while the USD remains subject to various internal and external influences that can impact its trajectory, recent indicators suggest a potential rally on the horizon. Traders and investors should closely monitor key factors such as Federal Reserve policy decisions, economic data releases, geopolitical events, market sentiment, and inflation trends to gauge the currency’s future performance accurately. An informed approach and nimble strategy will be essential in navigating the fluid landscape of the currency markets and capitalizing on potential opportunities presented by a USD rally.