Investing in Tin Stocks: Your Ultimate Guide

Understanding the Tin Market

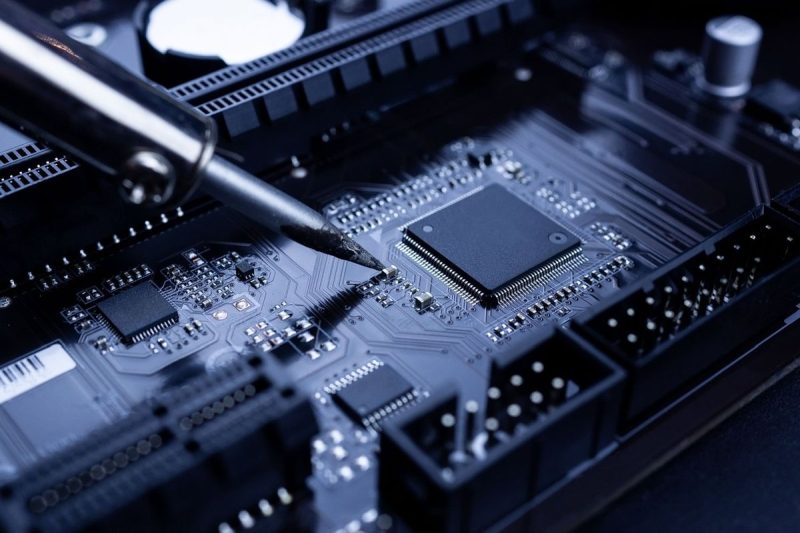

Before delving into investing in tin stocks, it is essential to gain a comprehensive understanding of the tin market itself. Tin is a versatile metal with various industrial applications, making it a valuable commodity. The demand for tin is driven by industries such as electronics, construction, and automotive, as it is used in the production of solder, tinplate, and various alloys.

Factors Influencing Tin Prices

Several factors influence the price of tin, which investors should consider before investing in tin stocks. Supply and demand dynamics play a crucial role in determining tin prices. Political instability in major tin-producing countries can also affect the supply chain and impact prices. Additionally, currency fluctuations and global economic conditions can influence tin prices.

Benefits of Investing in Tin Stocks

Investing in tin stocks offers several advantages to investors. As a commodity with essential industrial applications, tin is likely to maintain continuous demand, providing stability to tin stocks. Moreover, with the increasing emphasis on sustainable practices and the shift towards green technologies, the demand for tin in solar panels and electric vehicles is expected to rise, offering potential growth opportunities for investors.

Risks Associated with Tin Stocks

While investing in tin stocks can be rewarding, it also comes with certain risks that investors should be aware of. Tin prices are subject to volatility, influenced by various economic and geopolitical factors. Additionally, fluctuations in supply and demand can impact tin stocks, making them susceptible to market conditions. Investors should carefully assess these risks before investing in tin stocks.

How to Invest in Tin Stocks

There are several ways to invest in tin stocks, depending on individual preferences and risk tolerance. One option is to invest directly in tin mining companies that are involved in the exploration and production of tin. Another option is to invest in exchange-traded funds (ETFs) that focus on metals and mining, including tin. ETFs offer diversification and exposure to the overall performance of the tin market.

Research and Due Diligence

Before investing in tin stocks, it is crucial to conduct thorough research and due diligence to understand the market, identify potential investment opportunities, and assess the risks involved. Investors should analyze the financial health and growth prospects of tin companies, monitor tin prices, and stay informed about market trends and developments that could impact tin stocks.

Diversification and Risk Management

Diversification is a key strategy in managing risk when investing in tin stocks. By spreading investments across multiple tin stocks or related sectors, investors can mitigate the impact of any individual stock’s performance on their overall portfolio. Additionally, implementing risk management techniques, such as setting stop-loss orders and regularly reviewing investment strategies, can help investors navigate market volatility and protect their capital.

Conclusion

Investing in tin stocks can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the growth potential of the tin market. By understanding the fundamentals of the tin market, conducting thorough research, and implementing risk management strategies, investors can make informed decisions and navigate the dynamic landscape of tin investments successfully.