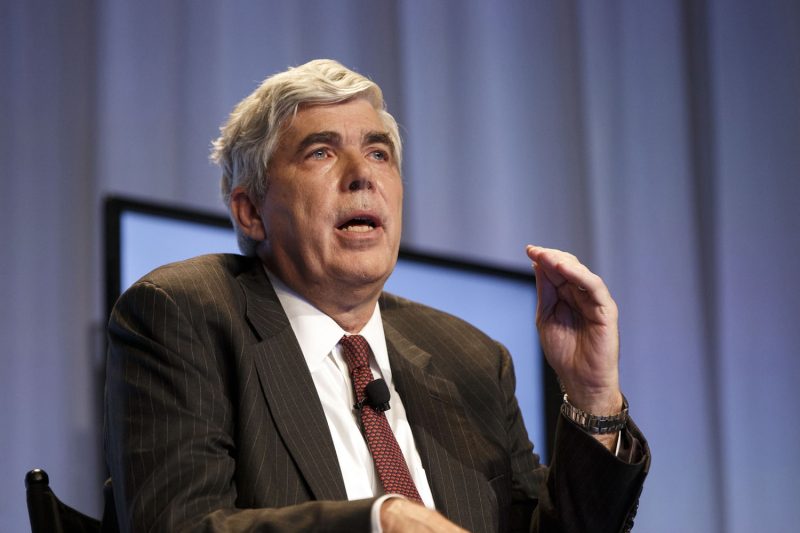

In the recently released news from Godzillanewz, the former WAMCO executive Kenneth Leech has been charged with fraud by the U.S. authorities. This development brings to light another case of alleged misconduct within the corporate world, highlighting the necessity for regulatory oversight and ethical conduct in financial matters.

The charges against Leech stem from his involvement in a scheme to falsify financial documents and misrepresent the company’s financial health to investors and stakeholders. These actions not only misled individuals and organizations who had placed their trust in WAMCO but also undermined the integrity of the financial markets as a whole.

Fraudulent activities such as those attributed to Leech can have far-reaching consequences, impacting not only the individuals directly involved but also the broader economy. When investors and the public are misled about the true state of a company’s finances, it can lead to significant financial losses and erode confidence in the market.

The case of Kenneth Leech serves as a reminder of the importance of maintaining transparency and accountability in corporate governance. Companies must adhere to strict ethical standards and ensure that their financial reporting is accurate and truthful. Regulatory bodies play a crucial role in monitoring and enforcing compliance, but ultimately, it is up to the individuals within organizations to act with integrity and honesty.

It is essential for companies to have robust internal controls and mechanisms in place to prevent and detect fraudulent activities. Employees must be trained on ethical standards and encouraged to speak up if they suspect any misconduct. By fostering a culture of integrity and transparency, companies can protect themselves and their stakeholders from falling victim to fraudulent schemes.

The charges brought against Kenneth Leech should serve as a wake-up call for companies and executives across all industries. The consequences of fraudulent behavior are severe and can have lasting implications for both individuals and organizations. By promoting a culture of honesty and accountability, companies can safeguard their reputation and build trust with their stakeholders.

In conclusion, the case of Kenneth Leech highlights the importance of upholding ethical standards and maintaining transparency in financial matters. Fraudulent activities can have damaging effects on individuals, companies, and the economy as a whole. It is crucial for companies to prioritize ethical conduct, implement robust internal controls, and promote a culture of integrity to prevent fraud and protect their stakeholders. Regulatory bodies and law enforcement play a critical role in holding individuals accountable for fraudulent activities, but ultimately, the responsibility lies with companies and their employees to act with honesty and integrity.